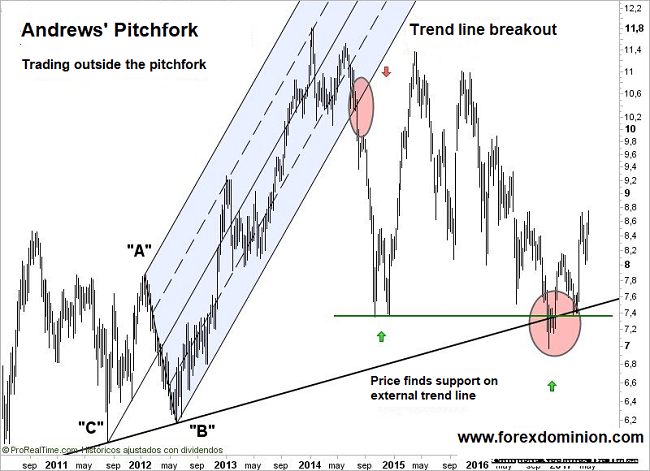

Once that trendline has been found, a parallel (copy) of that trendline can then be extended to the other side of the move (most recent key high / low) to create a channel - this is the very basics of identifying slope. The simplest way to get started in pitchfork analysis and median line trading is to identify an initial trendline of support or resistance that the market has been responding to. With the same respect, once the median-line is broken as resistance it will serve as support for a rally into the upper parallel - and the opposite when the median-line is broken as support (median-line will offer resistance on a move into the lower parallel). The base case scenario is that when prices comes off the lower parallel they will gravitate towards the median-line or bisector of the given range and vice versa off the upper parallel. If a price breaks above the median-line, the target shifts to the upper parallel – likewise if price breaks below the median-line, the target shifts to the lower parallel.ĮUR/NZD chart showing a parallels within a pitchfork Using Pitchforks and Median Lines The median-line of a pitchfork often offers a point of reference and may trigger inflections or pivots in price. These trendlines offer reaction zones and offer a guidance in both price and time.ĮUR/NZD chart showing a pitchfork What is a Median-line?Ī median line is simply the bisector of a given channel or range. Pitchforks were developed by Dr Alan Andrews as a basic trend tool that identifies price channels and gives structure to a market advance or decline. For more trading tips and strategies, view our Free Forex Trading Guides. To see these tools and methodology used in practice, join Michael for his Weekly Strategy Webinar. Part One: Introduction to Basic Trendline Analysis.

Foundations of Technical Analysis: Using Parallels and Pitchforks/Median Lines.This article on trading with pitchforks and median-lines is the second in a series exploring pitchforks and slopes: This will illustrate how we formulate a given trade opportunity using pitchfork analysis and median lines. We’ll start by exploring pitchforks and median lines in more detail followed by a deconstruction of a setup. The objective of this methodology is to attempt to identify the gradient or slope of the market trend in order to zero-in on possible levels of support and resistance. This piece focuses pitchfork analysis and median line trading, and reviews how parallels of these trendlines can be utilized to give structure to a market advance or decline.

0 kommentar(er)

0 kommentar(er)